Let’s be honest: Account-based marketing (ABM) can significantly expand revenue from your customer base. But ABM is advanced. It’s not simple, fast or easy to measure, and it can’t be done by one person “on the side” with no resources.

If you really want to win with ABM:

- It must be sponsored top-down and be given equal weight with traditional marketing and sales methods.

- Leadership in Marketing, Business Development, Sales and Customer Service must commit to a dual system in which Demand Generation attracts net-new customers and ABM expands customer engagements.

- Enterprises that have grown via acquisition must pay very close attention to the silo-bridging cooperation account-based marketing requires

- Plan a 3-year crawl-walk-run roadmap to pilot, adjust, and accelerate.

The technology is not cheap, and only part of the equation. It is incredibly complex. But, if you’re ready to to truly invest in account-based marketing and do it well, read on to learn what you need.

Click to jump to section: What is ABM? | Statistics | Strategy & Tech | Key Concepts | Get Started

Want more? You can always grab our ABM checklist, or learn more of what our team can do to for you with our ABM consulting services.

Let’s level-set: What is account-based marketing?

It may seem fundamental, but definitions seem to vary depending on which company I’m speaking with!

Account-based marketing is a holistic marketing approach that’s cross-functional with sales and customer succes, and focused on accounts rather than contacts. The focus is often on cross-selling and upselling instead of net new clients.

(To be honest, I prefer calling it Account-Based Experience)

Rather than casting about for leads, companies try to expand their business within target accounts – particularly focusing on buying committees and key decision-markers.

It’s best for companies that have a clearly-defined set of potential client companies and want to maximize their footprint in each.

Another key difference is that Marketing, SD and Sales all work together to orchestrate sales using cross-functional plays. The measure of success for ABM is not just MQLs or SQLs, but revenue and retention gains for key accounts. It’s truly a revenue marketing mindset.

Many organizations that embark on ABM fail to track success metrics well, making the benefits not quite as easy to spot as any markter would like them to be. Here’s a few eye-opening statistics:

ABM Statistics:

- 87% of marketers say ABM outperforms all other marketing investments in terms of ROI (ITSMA)

- Average contract value increased by 171% after implementing Account-Based Marketing (ABM Alliance Research)

- 86% of surveyed companies reported higher close rates with using Account-Based Marketing and increased lifetime customer value (Topo, via 6Sense)

- The top three roadblocks listed were: Lack of ability to execute, poor sales / marketing alignment, and bad data quality (Engagio)

- Less than 15% of companies have had a program in place for more than two years, and more than half haven’t started to measure their ABM programs.(Demandbase/Engagio)

- 53% of respondents haven’t started to measure ABM. Of those that do, the top 3 most common ABM metrics tracked are Pipeline Created, Revenue Generated and Account Engagement. (Demandbase/Engagio)

- More than 57% have reported significant increases in per-account pipeline and 59% significant increases in per-account revenue. 69% see significant increases in cross and upsell

- Budget allocation to ABM has increased 40% YoY (Demandbase and Terminus)

If you’re starting to worry about your readiness (or current implementation), read 4 Reasons Your Company May Not Be Ready For ABM before continuing on.

ABM Strategy & Tech

For all the talk about it, ABM is still a young solution in terms of adoption. About 70% of B2B companies have started building out an ABM program, but less than 15% have had a program more than 2 years. 40% have been doing ABM for less than 1 year. (Demandbase/Engagio)

Common challenges are around data quality, ability to execute, lack of resources, internal alignment and measurement. Even the most advanced ABM programs are still focusing on measurement, execution, data quality and alignment as they mature.

Many organizations start by purchasing expenses ABM tools, an approach with pros and cons. Check out my blog on this very topic: How Much Tech Do You Need For ABM?

ABM Key Concepts

Strategic, Scale, Programmatic ABM

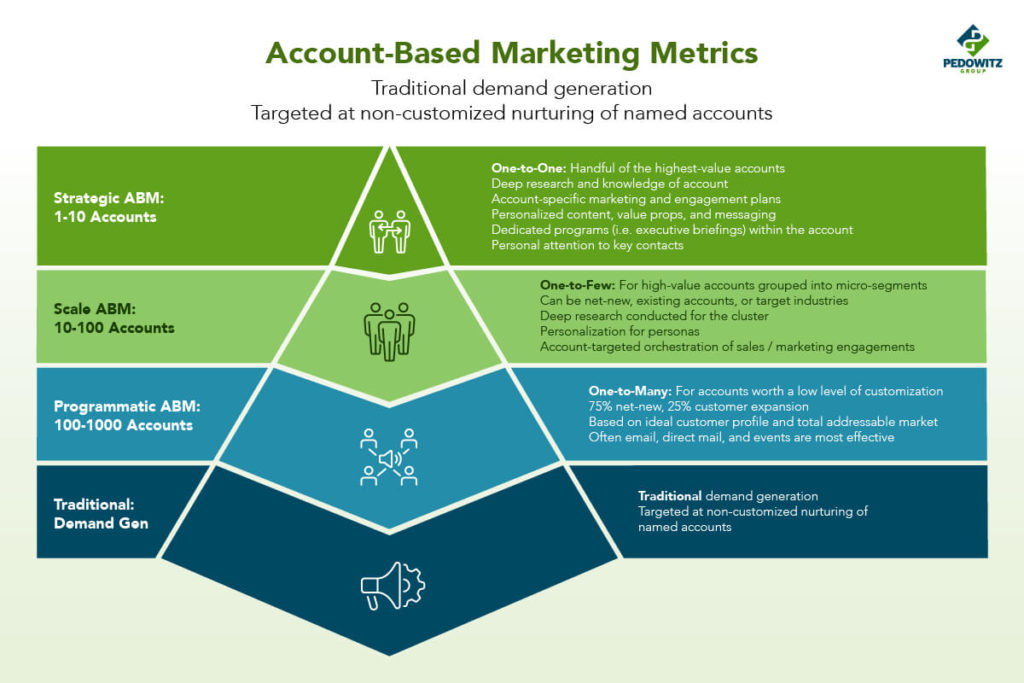

Most ABM models describe four stages, so let’s examine from the bottom up.

Traditional demand-gen marketing for named accounts…

Programmatic for one-to-many marketing, often adapted by industry…

Scale ABM for one-to-few customized marketing to key roles in your top 100 accounts …

… and Strategic ABM for one-to-one personalized marketing to your top 10 accounts and key contacts therein. Many companies choose a mixed ABM approach with some of each style.

ICPs, BCPs and CXPs

Your Ideal Customer Profile (ICP) is the yardstick you hold other accounts up to. It’s a detailed description of your best prospective client, actual or symbolic. Once you have an ICP, use it as a yardstick to sort your accounts into tiers. A good ICP match and lots of institutional knowledge points to strategic ABM. And vice versa.

Related: Update your customer journey(s)

Buying Committees or Centers are common in companies preparing to make large investments. Buying Committee Participants (BCPs) need decision-making information based on their role. For example, Decision Makers may be focused on budget, Champions on problem-solving, and Influencers on doing the research they’ve been assigned. Ratifiers may be focused on IT interoperability, security measures, legal requirements, or procurement processes.

As you select ICP-like accounts to pursue, consider the information needs of the BCPs at each stage. Assemble a Customer Experience (CXP) or Customer Journey for each of them. This may mean creating several distinct campaigns.

Dynamic Intent Data

First-party intent data comes from your own databases, and tools you already own can help surface it. But many organizations prefer to buy third-party intent data, which is becoming increasingly more sophisticated. (D&B)

Account-based marketing tools use IP addresses and cookies to match buying signals – or intent data – from all over the internet to accounts in your CRM. Most often the data being tracked is keyword-based research activity.

Some tools can use AI and ML to analyze historical and real-time data, then predict future outcomes. Unlike traditional tools that use static segments, these sophisticated ABM tools are dynamically updating data, continuously refreshing data from third-party providers.

Organizations can leverage buyer intent data to: Prioritize inbound leads based on their engagement with you and reach out to the right prospects at the right time with personalized messaging.

Tracking In-Market ICPs

Remember that Ideal Customer Profile we talked about earlier? What if you could know when companies that match your ICP are “in market” or ready to engage? That’s what those third-party ABM tools do, and they call those hot accounts, “In-Market ICPs.” Let’s take a look…

Intent data lets you see actual prospects in action. But that doesn’t mean they are ripe for a sales call – in most cases you still need to nurture all the account BCPs along their journeys.

AI-based ABM platforms allows Marketing and Sales to watch meaningful metrics like engagement levels by BCP or individual. This allows you to customize outreach in ways that nurture prospects in less creepy ways such as retargeting, personalized site content, and focused email campaigns.

Account Engagement Scoring

AI-based ABM platforms allow both Marketing and Sales to watch meaningful metrics like engagement levels by BCP or individual. This allows you to customize outreach in ways that nurture prospects in less creepy ways such as retargeting, personalized site content, and focused email campaigns.

Because content, channels and tactics can vary so much by account and BCP, definitions of success may also differ. This is where account engagement scoring comes into play. Marketing Automation Platforms such as Eloqua contains several baked-in reports for showing activity at an account level (versus a contact level). The Account Summary shows contacts and activities for your top 100 accounts for the last month or two-weeks (those are the choices).

For your top 10 accounts, you can access more detail in the Top Engaged Accounts report and the Activity Timeline reports, which graphs one account at time. As you see, you can access and share some valuable information from these reports. Good place to start.

Later on you may consider more advanced “full funnel” ABM tools such as 6Sense, Demandbase, Terminus, or whomever is on top by then. These tools not only identify IICPs based on keyword activity but rank them according to your specific criteria, often using ML and AI.

Target Account Pipeline

Target Account pipelines differ from traditional pipeline reports in two major respects: First, instead of tracking MQLs, your marketing group may be tracking MQA’s – marketing qualified accounts. Second, a unified pipeline shows all touchpoints (Marketing, BizDev, Sales) and how they are working together to meet the information needs of all BCPs.

Sales may be watching the number and percentage of accounts engaged, both new and known. Executives may be watching the number and value of accounts in the pipeline. Ultimately all are watching the opportunities from Target Accounts, the increase in close rate, the average deal size and the increase in funnel velocity.

Attribution & MROI

No matter which role you play in an organization, you want credit for revenue you influenced, right? Attribution tools track and model all the touches that lead to closed-won opportunities. These can be surfaced in your CRM – in this case Salesforce is displaying first and last-touch attribution data.

Marketing is increasingly responsible for demonstrating MROI, or “Marketing Return on Investment” so tools like this are critical to proving value and earning more budget. Much can be done in your Marketing Automation Tool, but the more detail you need about attribution, the more likely you might need a third-party tool. (Demandbase)

Orchestration

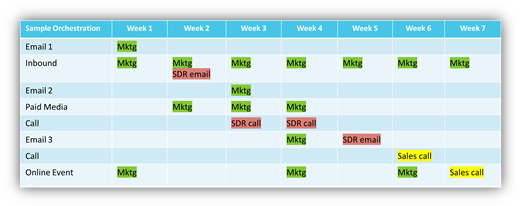

ABM differs from a traditional B2B sales funnel in that the whole organization has a part to play. Marketing doesn’t just throw leads over the fence, sales actively takes the handoff. At every stage, accounts are scored and handled according to agreed-upon guidelines.

For example, Marketing might synchronize paid media, email campaigns, and personalized web experiences. BDRs might then pickup with coordinated cadence marketing scripts. Finally, field Sales does custom presentations and handshakes.

Each touchpoint continues the conversation and nurtures the account forward.

Related: Four reasons you aren’t ready for ABM

Get Started

I’ve thrown a lot of terms and steps at you, so check out this handy list for your best-practice order of approach:

- The first six foundational steps are about optimizing your account knowledge and preparing your approach to the most valuable.

- The next six steps are about targeting key account contacts with relevant messages, content, touchpoints and plays. All require continuous measurement and improvement.

- Still in the planning phase? Read our ABM prerequisites checklist.

- Read more on ABM: Three key secrets to know and how much tech do you really need?

- Need a helping hand refining your ABM strategy, want an expert to give your marketing a once-over, or seeking to do more with what you have? Our account-based marketing consulting is for you!