Mergers and Acquisitions (M&A) have always been nuanced endeavors, and they seem to be picking up the pace substantially in 2022. In 2021, Executives were putting deals into writing. Take private equity, for example, which saw $945 billion dollars in buyouts in the US alone. That’s two and a half times the volume from 2020.

Fast forward to the present, there doesn’t seem to be any end in sight. In a post-pandemic world, the M&A landscape looks different than it has in the past, with a substantial portion of businesses being digitized. So, how do you wrap your head around this supercharged mergers and acquisition landscape?

Most importantly, how does this affect revenue operations?

Let’s talk about that, shall we?

How Has COVID19 Spurred Record-Breaking M&As?

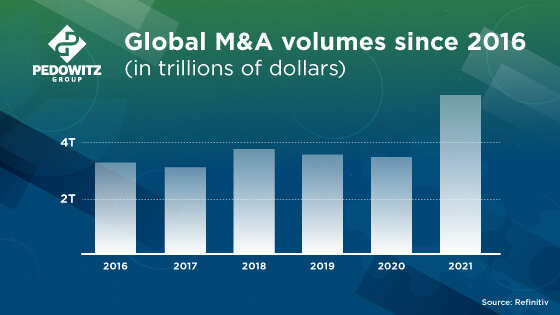

All over the world, M&A activity rose to unprecedented levels in 2021, reaching a record-breaking $5.1 trillion globally. Investors are now seeing a clear path to recovery, and businesses are looking at a future beyond the pandemic. Both sponsors and corporates alike feel very good about the environment in 2022 and are pursuing opportunities aggressively before the market inevitably corrects itself.

This means they’re looking to get ahead of the curb, utilizing this opportunity to add capabilities and grow by buying out or merging with businesses that may not have fared as well throughout the pandemic.

This also means that the businesses themselves are looking very different that in the past. More and more companies are operating remotely, which spurred the need for organizations to optimize their digital processes for both B2B and B2C operations. We discussed this at length in our Digital Transformation revenue growth primer.

What Role Can Revenue Operations Play When Companies Merge?

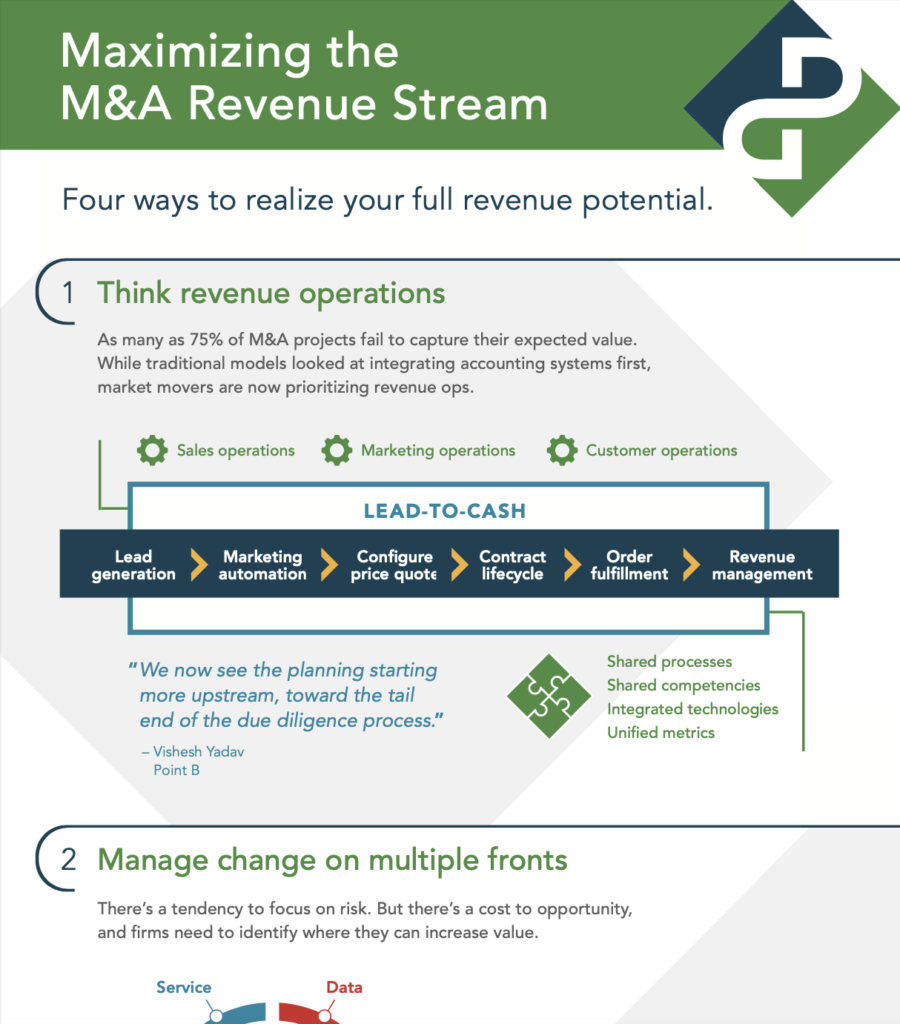

Whenever companies merge there’s typically a massive amount of data, strategies, marketing efforts, and other operations. Revenue operations (and the RevOps team) essentially takes an end-to-end approach to managing these pillars and makes them more of a holistic, centralized hub.

Think of a revenue operations team as a group dedicated to merging sales, customer success operations, and marketing efforts. When companies merge, committing to a revenue operations team allows to overall objective to be more strategic about their marketing effort and sales decisions.

Revenue operations also focus on bottom-line growth and scaling activities, so they collaborate closely with the sales, customer support, and marketing departments of both parties to ensure that bottom line is met. This in turn also allows the RevOps team to take notes on employee retention and satisfaction.

Related: Read how to embrace revenue operations

How Do You Address Organizational Structure and Operational Gaps?

Organizing for growth means you’re going to be integrating both parties in such a way that they can work synergistically. Operational gaps need to be filled for the merger to be successful, and there will almost always be at least one operational gap between two companies as no business works in the same fashion. This generally involves integrating teams together and some departments assuming a larger share of responsibility, but there are cases where two formerly independent companies can still operate separately. This is especially true for mergers where the product lines might be wildly different, requiring different technical expertise, sales, and marketing knowledge to keep driving the pipeline forward.

Prior to finalizing the merger or acquisition, make sure both parties have a very clear outline of the organizational structure. That way they can be reviewed, and discussions can be made about how to successfully integrate everything so that there are no operational gaps.

Related: Grab this talent bundle

How Do You Address the Customer’s New Identity Post-Merger?

Most-merger and acquisition branding strategies often vary to a certain to degree, but a fundamental component that all successful M&As utilize is consistent, ongoing and open channel communications with all stakeholders. It’s quite common for a company to not even think about branding until the merger or acquisition is completed.

Make sure all stakeholders are involved in the planning process for branding post-merger. There should be discussions in the very beginning talks about branding identity. A successful new brand identity can have a synergistic effect, capitalizing on the benefits and weight both brand names bring to the table.

But, if not properly planned out before the merger or acquisition is finalized, you’re left with not only a confusing set of product and service branding issues for the companies involved, but also for the customers themselves.

How Do You Sustain Lead Quality and Ensure the Pipeline Stays Strong?

Maintaining lead quality is critical during the post-merger or acquisition period. The salesforce often has relationships, regions, and strategies that work very well with their target leads. Bringing two companies together can be a great way to get additional products and services in front of quality leads, but only if the process is handled carefully.

For example, say there’s a company that has a certain product line that is similar, but not identical to an organization they’re recently merged with. Now, both of these companies previously had a sales rep in the same region, and they’re both now afforded access to both companies’ products lines.

Which one should be able to make sale to that customer? In most cases, you should leave your sales and marketing efforts in the hands of the person or group that had previously established the leads and relationships, but there are always exceptions.

As with most things involved with M&As, plan your pipeline strategy ahead of time.

Related: Get it right with our lead management consulting

What Key Areas Should You Focus on During M&A Activity?

Of course, M&A activity can get complicated, especially when you don’t have good, clear communication and a defined set of key points you should be honing in on in order to ensure everything goes smoothly.

Here are a few steps to focus on during a merger or acquisition:

- Keep an eye on your financial health and liquidity – Before entering any transaction, you should have had a thorough financial check to ensure you’ve got the liquidity to successfully carry of the transaction. Since COVID19, many organizations have redirected their focus away from loss statements and profits in favor of liquidity. Once appropriate liquidity has been determined, then determine whether your capital structure is capable of handling the additional stress.

- Have a transition team with clear visibility – You want to make sure you’ve got a team put together that has the skills and experience necessary to oversee and assess the transitionary process, forecast how it’s performing, and navigate that process with care. Having a team together that’s focused on specific aspects of the merger and acquisition will help keep the overarching objective clear and help integrate the two organizational structures.

- Define success factors – When strategizing merger and acquisition activity, closely observe your strategic position as well as your future goals. That means getting a clear understanding of exactly what you’re trying to gain from the whole process. Are you wanting to increase your market share? Do you want to enter new markets? Do you want new intellectual capital or products? All things to consider.

Mergers and Acquisitions can be an excellent opportunity for growth, and M&A activity post-pandemic shows that investors are seeing M&As as an opportunity more than ever before. With careful planning and a high-quality revenue operations team to help everything integrate successfully, you could be well on your way to a successful M&A venture.

For more information, download our M&A panel discussion with a group of trusted thought leaders and industry experts.

Or, look into more great content on our Resources page!